SICPATRACE

SICPATRACE

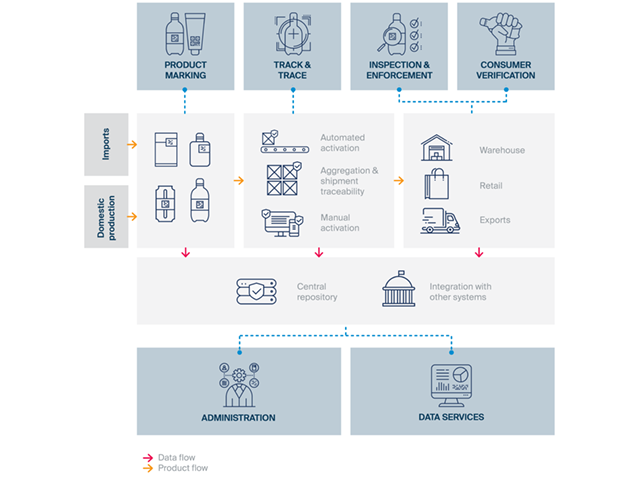

A tailored solution designed for governments to optimize fiscal revenues on excise goods. SICPATRACE® is a digital tax stamp management system used by government authorities for nation-wide control of supply chains involved with the production, import, export and distribution of excise products. Examples of product categories include tobacco, spirits, wine, beer, as well as other consumer goods, including soft drinks and mineral water.

Currently deployed in 17 countries, SICPATRACE® monitors supply chains by uniquely and securely marking, tracking, tracing and authenticating goods throughout their life cycle. This provides full visibility to authorities looking to reduce illicit trade practices such as under-declaration, tax evasion, smuggling, counterfeiting and distribution of unauthorized goods.

With SICPATRACE

- Recover tax lost to illicit trade, reinforcing the local economy and fair trade

- Leverage the most counterfeit-robust technologies needed to eradicate fraud and illicit trade

- Monitor the supply chain of excise goods and detect infiltrations by illicit flows

- Reinforce governance through transparency

- Build consumer engagement in the defence of legit goods

- Integrate without interfering with the industry’s manufacturing and distribution processes

SICPATRACE

is fully integrated yet modular solution in

SICPATRACE® is #1 secure track & trace platform around the world

Why SICPATRACE?

Implementations of SICPATRACE® around the world have stood the test of time. Since 2004, our GS1 and WHO FCTC compliant solution has been implemented in 17 countries and on more than 1,000 production lines covering various industry sectors.

Yearly, more than 80 billion products are marked, tracked and traced by SICPATRACE®, making it the go-to trusted system for controlling supply chains of excise goods by governments and manufacturers. With a capacity to mark over 60,000 products per hour on a manufacturing line, SICPATRACE® is the most tested option to control manufacturing environments running at high speed, in a non-intrusive fashion.